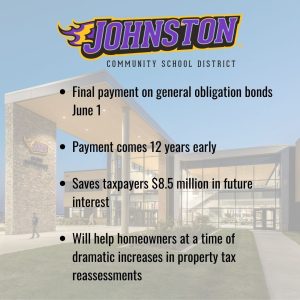

Johnston schools to save taxpayers $8.5 million

The school district is scheduled to make the final payment of principal and interest of its general obligation bonds for construction of its high school and prior debt by June 1 this year. The early payoff comes 12 years before the originally scheduled final payment in fiscal year 2035, saving taxpayers a whopping $8,488,100 in future interest costs.

“This amazing example of fiscal responsibility is not something that happened overnight,” said Laura Kacer, superintendent of the Johnston Community School District. “It’s the collective effort and decisions of several school boards, who decided to aggressively pay off our debt. Now, taxpayers will see the benefit.”

Ryan Eidahl, the district’s chief financial officer, explained to the school board Monday night that instead of the school district charging taxpayers $17.75 per $1,000 of assessed valuation, the amount levied will be $13, instead. That could, for example, save taxpayers $496 on a $200,000 home. Johnston’s tax rate is projected to be the lowest for Des Moines-area metro schools in 2023-24.

The change only affects the school district’s portion of the levy because a homeowner’s overall property taxes are also impacted by other taxing entities.

General obligation bonds are municipal bonds which provide a way for state and local governments to raise money for projects that may not generate a revenue stream directly. In Johnston, most of the bonds (along with funding from PPEL and sales tax) were used to build a brand new, state-of-the-art, 369,000-square-foot learning facility for Johnston High School at 6500 NW 100th St., which was completed in 2017.